What is embedded finance? A revenue playbook for SaaS growth

Learn what embedded finance is, how it works, and why it matters. This guide explains the embedded finance market, real examples, and trends shaping its future.

What do Wix, Toast, Uber, and Shopify have in common?

They move money, issue cards, offer credit, and handle payouts right inside the product.

That’s embedded finance: putting financial tools where customers already work.

For product leaders and founders, embedded finance has become a practical means of growth. It helps increase revenue, keeps customers around longer, and turns a tool into something users rely on every day.

In this guide, we’ll show you how embedded finance works and why it’s becoming a core growth strategy for modern SaaS companies.

We’ll cover the essentials, including:

- What embedded finance means

- Examples across payment, banking, lending, and more

- How it works behind the scenes

- Why top SaaS companies are building financial features into their products

- What it takes to launch and how to do it without reinventing the wheel

Ready to turn your product into a revenue engine?

Whether you’re exploring embedded payments, lending, or full-stack banking we’ll help you launch faster, stay compliant, and unlock new revenue streams.

Chat with an expert or see a live demo.

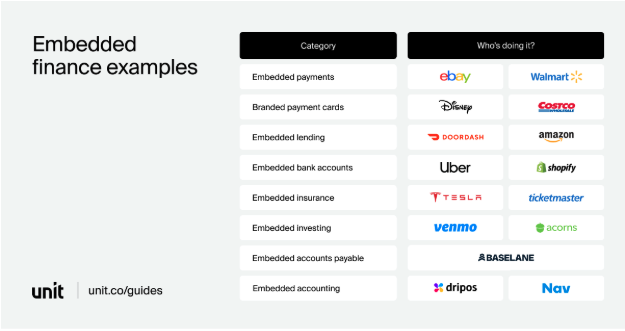

What does embedded finance look like in practice?

What used to be a trip to the bank or a separate app is now built into the tools people already use to pay, borrow, save, or insure.

Here are some common examples of embedded finance, grouped by type:

1. Embedded payments

Online checkout was the first widespread use of embedded finance, and it’s now table stakes.

Platforms like Shopify, Wix, and Toast let their users accept card and bank payments directly from their storefront or dashboard.

Today, most payments on the internet happen through embedded flows powered by providers like Stripe, Adyen, and Checkout.com. These tools abstract away the complex parts—payouts, reconciliation, compliance so customers can just plug in and go.

This model also extends to embedded finance for consumer apps. Think: ride-hailing, food delivery, or mobile shopping, where users expect to tap, pay, and move on without leaving the app.

And it works.

More than 73% of Shopify’s revenue now comes from merchant services, the majority of which are embedded financial products like payments and capital advances. That shift has turned Shopify from a software provider into a full financial partner for its merchants.

2. Branded payment cards

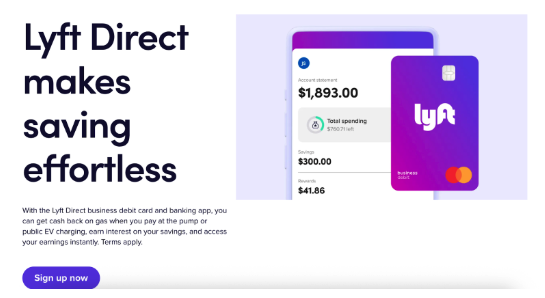

From Target’s REDcard to Uber’s driver debit card, branded cards offer rewards and real utility.

For example, Lyft’s co-branded debit card, issued in partnership with Stride Bank, gives drivers instant access to earnings and cash back on gas.

These cards build loyalty and let platforms offer benefits banks wouldn’t typically design. They’re also revenue-generating: each transaction creates interchange income for the platform.

3. Embedded lending

Buy now, pay later (BNPL) is the most visible form of embedded lending. Affirm, Klarna, and Afterpay let users split payments at checkout, increasing conversion for merchants.

But the category goes far beyond BNPL:

- Amazon provides revolving credit lines to eligible sellers.

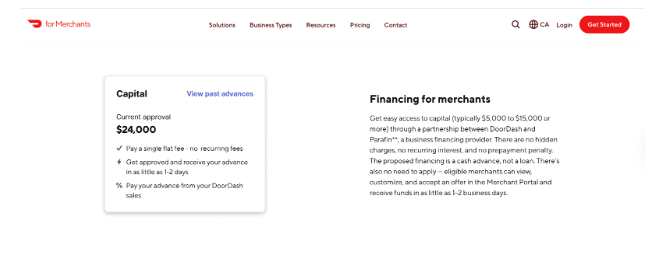

- DoorDash offers cash advances to drivers based on their earnings history.

- Toast and Ramp offer term loans and charge cards tailored to small businesses.

Because platforms understand their users' cash flow better than traditional banks do, they’re in a strong position to underwrite and offer more relevant terms.

4. Embedded bank accounts

Uber was one of the first to launch branded accounts for its drivers.

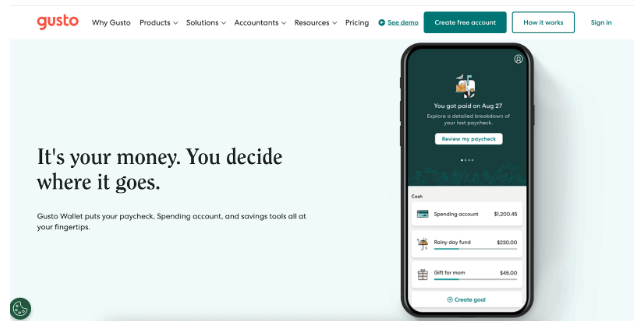

Now, embedded banking is everywhere: Shopify Balance, Gusto Wallet, and AngelList Stack all let users hold and move funds without relying on a traditional bank.

These accounts often come with built-in savings, debit cards, and faster access to payouts—all under the platform’s brand. The goal is to give users more control over their money while keeping them inside the product.

5. Embedded insurance

Adding insurance at checkout is now common across industries. You’ve probably seen:

- Event insurance for concert tickets.

- Travel insurance when booking a flight.

- Shipping insurance with e-commerce platforms like EasyShip.

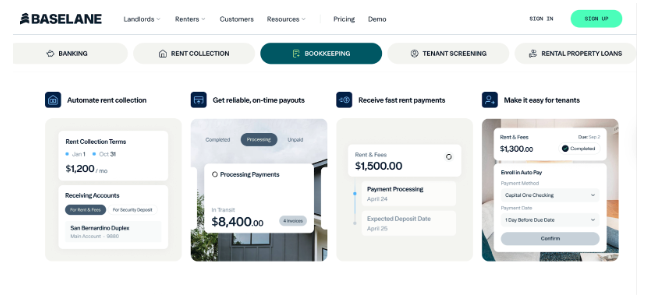

Other examples include Tesla offering car insurance in-app, or Baselane letting landlords bundle homeowners insurance into their financial tools.

6. Embedded investing

While still early, some companies are starting to fold investing into everyday products:

- Venmo allows users to buy crypto directly in the app.

- Acorns rounds up spare change into stock purchases.

As embedded investing matures, we’re likely to see more tools that make wealth-building feel native to everyday digital experiences.

7. Embedded Accounts Payable

Some platforms are embedding tools that let users manage recurring costs like subscriptions, rent, or utilities directly from their dashboard.

Baselane, for example, gives landlords an all-in-one view of property expenses, allowing them to automate bill payments and track utilities all without leaving the platform.

The value here is twofold:

- Users get a clearer view of their cash flow.

- Platforms become more central to everyday financial management.

This creates stickiness and opens the door for layered features like automated payments, real-time alerts, or even financing when cash is tight.

10. Embedded Accounting

For platforms serving businesses, freelancers, or landlords, taxes are a constant friction point.

Embedded tax tools like automatic 1099 generation, real-time expense categorization, or sales tax calculation can turn that pain into a product advantage.

For example, Nav uses embedded accounting features to give small businesses a real-time view of cash flow, categorize expenses, and stay financially healthy—right from their dashboard.

Another example is Dripos, a POS system built for coffee shops, which includes invoicing, financial reporting, and cash management directly within the platform. Café owners don’t need a separate accounting tool as it’s all built in.

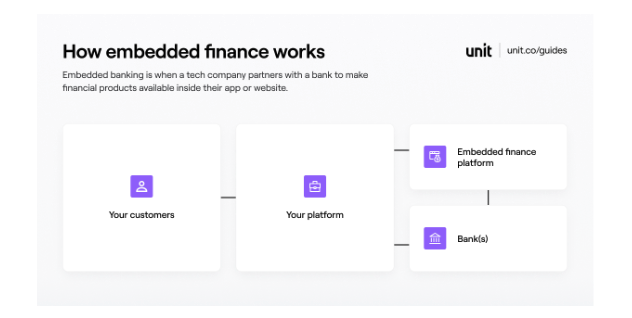

How embedded finance works

Behind every embedded payment, loan, or card is a complex set of banking and compliance infrastructure. Embedded finance makes that complexity invisible for both the user and the platform.

Here’s a breakdown of how it works behind the scenes:

Licensed financial services sit behind the scenes

Most financial products, like bank accounts, cards, and lending, can only be offered by licensed institutions. That means embedded finance always starts with a regulated bank or financial provider in the background.

But instead of building direct integrations with banks (which is slow, rigid, and expensive), companies now use embedded banking platforms like Unit (previously known as banking-as-a-service (BaaS).

These platforms already partner with banks, maintain the infrastructure, and offer APIs that let tech companies access banking rails without becoming a bank themselves.

As Amanda Swoverland, Chief Compliance Officer at Unit, explained during a recent In Fintech We Build Trust LinkedIn Live event:

“There’s always a bank behind the scenes, even if it’s not the one doing all the work. The bank holds the responsibility, whether it’s generating statements, calculating APY, or processing transactions. What varies is how those responsibilities are divided across partners.”

Whether you’re offering bank accounts, cards, or lending products, every component—from onboarding and fraud checks to interest calculations —is governed by strict rules. Embedded finance platforms handle these responsibilities in coordination with the bank.

Ready to turn your product into a revenue engine?

Whether you’re exploring embedded payments, lending, or full-stack banking, we’ll help you launch faster, stay compliant, and unlock new revenue streams.

Chat with an expert or see a live demo.

APIs power the user experience

APIs (application programming interfaces) are what connect your app or website to financial infrastructure. They allow you to trigger financial actions—like sending a payment, opening an account, or checking a balance—through simple software calls.

For example:

- When a user sends money, the API talks to the banking system to move funds.

- When they use a branded card, the API routes and settles transactions in real time.

- When they apply for credit, the API handles underwriting, terms, and repayment logic.

APIs take away the heavy lifting so your team can focus on product and UX, not backend data sourcing.

The user sees a branded, seamless experience

While the infrastructure is powered by partners, the experience is fully yours. Most embedded finance offerings are white-labeled or co-branded, so the user sees your name, not the bank’s.

This means:

- Fully-branded bank accounts offered by your app.

- The loan or cash advance appears directly in your dashboard.

- The card carries your brand and rewards.

And because the experience is embedded in context next to payroll, scheduling, or invoicing, it feels natural.

Why embedded finance matters for tech companies

Tech companies are becoming essential financial platforms. Embedded finance for business helps you monetize, improve user retention, and stay ahead of customer expectations.

Here’s why it matters:

- Boosts revenue per customer: Embedded finance allows you to monetize financial actions like payments, lending, and account usage. According to McKinsey, companies using embedded finance see 2–5x higher customer lifetime value.

- Lowers acquisition costs: You don’t just drive more revenue—you acquire customers more efficiently. McKinsey reports that embedded finance can reduce acquisition costs by up to 30%. Instead of running separate campaigns or relying on banks, you're meeting customers inside a product they already use and trust.

- Increases retention and product stickiness: Financial features like instant payouts, branded cards, or built-in credit give users a reason to keep coming back. Once customers rely on your platform for both operations and money movement, churn drops and engagement deepens.

- Scales without traditional overhead: Thanks to APIs and modern fintech infrastructure, embedded finance lets you launch fast, without building a bank in-house. You control the experience, branding, and strategy, while licensed partners handle the backend.

The market opportunity

“Embedded finance isn’t a zero-sum game. It can grow to be as big as finance itself—because it’s simply a new distribution layer. And when you rethink what financing or spend management can look like, it’s clear: we’re still in the pre-Uber era of financial services.” - Itai Damti, Co-founder & CEO, Unit, from the “Intro to Embedded Finance” webinar

Most of the market still treats embedded finance like a wrapper around traditional products. But the next wave will go deeper: smarter, more tailored, and native to the user’s workflow. As Itai puts it, we’re still in the pre-Uber phase, and the real transformation is just getting started.

The numbers back it up. In 2023, the market was valued between $82 and $108 billion (IMARC, Grand View Research). By 2025, estimates place it at $146 to $148 billion, and forecasts for 2030 range from $690 billion to $7.2 trillion, depending on how broadly the opportunity is defined (Precedence Research, World Economic Forum).

Most analysts agree on one thing: growth will be fast. The market is expected to expand at a 28% to 36% compound annual growth rate over the next decade (Allied Market Research, MarketsandMarkets).

Annual growth rates are expected to stay strong, with a 28% to 36% CAGR through the next decade (MarketsandMarkets, Allied Market Research). North America leads today, but Asia-Pacific is catching up fast, especially in mobile-first and B2B ecosystems. Key industries driving this growth include retail, logistics, healthcare, and vertical SaaS.

Despite rising adoption, analysts say up to 80% of the addressable market remains untapped, particularly in B2B workflows like payments, lending, and insurance.

With strong infrastructure in place and new fintech partnerships emerging, embedded finance is quickly becoming a core strategy for any tech company serious about monetization and retention.

📺 Want to hear more? Watch this snapshot from Itai Damti as he breaks down why embedded finance is still early and how it’s reshaping the financial services industry.

The future of embedded finance

As platforms and users grow more comfortable with integrated financial tools, the next wave will be defined by personalization, scale, and smarter risk.

- AI and hyper-personalization: Real-time credit decisions, fraud detection, and tailored financial offers will become table stakes. AI will expand credit access and reduce risk, especially for underserved users.

- B2B and SMB focus: The next wave of growth is in business finance. Expect embedded lending, payments, and BNPL to reshape how SMBs handle procurement and cash flow.

- Decentralized and programmable finance: Blockchain-based infrastructure will enable transparent, programmable financial flows, especially in use cases that demand trust and automation.

- Platformization and ecosystem plays: Software platforms will offer full financial suites—cards, accounts, lending—through fintech partnerships. Banks, BaaS players, and SaaS tools will collaborate more closely.

- Regulatory evolution: Compliance will mature fast. AI explainability, data privacy, and licensing clarity will become critical, especially in the US, EU, and digitally advanced markets like India.

- Sector expansion: Beyond payments and lending, we’ll see growth in insurance, investing, and banking. Vertical SaaS platforms will offer industry-specific financial products by default.

- Challenges ahead: Trust, security, and compliance will define winners. As the category scales, only platforms that deliver real utility and protect their users will endure.

Ready to explore embedded finance?

Embedded finance helps increase revenue, improve retention, and make your product an essential part of your users’ daily lives. But you need the right infrastructure, compliance you can trust, and a partner who’s done this before.

With Unit, you get a complete platform to build embedded banking and lending solutions, built from scratch, backed by multiple bank partners, and trusted by 200+ companies.

Ready to turn your product into a revenue engine?

Whether you’re exploring embedded payments, lending, or full-stack banking, we’ll help you launch faster, stay compliant, and unlock new revenue streams.

Chat with an expert or see a live demo.

Frequently asked questions about embedded finance

What are examples of embedded finance?

Here are ten of the most common examples, with real-world companies putting them into practice:

- Embedded payments: Platforms like Shopify and Wix let users accept card and ACH payments directly inside their storefronts. In consumer apps, this is the “tap and go” experience users now expect.

- Embedded lending: DoorDash Capital provides cash advances to restaurant partners, while Amazon offers revolving credit lines to sellers. These tools give users access to capital without leaving the platform.

- Branded payment cards: Uber and Lyft offer debit cards for drivers, enabling instant payouts and rewards like cash back on gas. These cards strengthen loyalty and generate interchange revenue.

- Embedded bank accounts: Tools like Gusto Wallet, AngelList Stack, and Shopify Balance give users the ability to hold funds, pay bills, and track cash flow—without needing a separate bank.

- Embedded insurance: At checkout, customers can add insurance for tickets, travel, or shipping. Tesla, for example, lets drivers manage their car insurance directly in the app.

- Embedded investing: Platforms like Venmo and Acorns let users invest spare change or buy crypto directly from their balance without a separate brokerage account.

- Digital wallets: Embedded wallets (or financial accounts) like those offered by Payoneer or Gusto let users store, send, and receive money inside the product. This helps with retention and creates new revenue paths. Make it easy for your customers to store money without the need for a traditional deposit account.

- Subscription and bill management: Baselane enables landlords to manage rent, utilities, and property expenses from one dashboard, automating cash flow and reducing admin overhead.

- Currency exchange: Businesses with global reach, like Payoneer, offer built-in FX tools that let users convert between currencies without leaving the product.

- Tax services: Tools like QuickBooks and Baselane provide built-in tax tracking, write-off categorization, and 1099 prep, saving users hours and reducing churn during tax season.

How big is the embedded finance market?

The embedded finance market was valued between $82 and $108 billion in 2023 and is projected to reach $146–148 billion by 2025. By 2030, forecasts range from $690 billion to $7.2 trillion, depending on scope and adoption across sectors. Growth is driven by vertical SaaS platforms, B2B tools, and rising global demand for integrated financial services.

What’s the difference between embedded finance and banking-as-a-service (BaaS)?

Embedded finance is when financial services like payments, lending, bank accounts, insurance, investing, or tax tools are integrated directly into a non-financial product. It’s what the end user sees and interacts with, all without leaving the platform they’re already using. Banking-as-a-service is the backend infrastructure that powers it.

BaaS providers supply the licenses, infrastructure, and APIs needed to offer these financial features compliantly and at scale. In short, embedded finance is the what, and BaaS is the how.