Introduction

When you onboard end-customers to our platform, they are checked within seconds and typically automatically approved by our system. In some cases, we may need additional documentation from the customer or to conduct a manual review ourselves. In those cases, Unit will investigate, manage, and quickly resolve the issue.

This guide explains how our end-customer onboarding process works, including details on:

- The information we require for individual and business end customer applications.

- Common reasons why applications may require manual review.

- Common reasons why submitted documentation may be rejected.

Information Collection

To comply with Bank Secrecy Act laws, you will be required to collect and pass certain information to Unit depending on the type of applicant (see our API documentation).

Key Terms

- Individuals are natural persons.

- Businesses are legal entities (but may include individuals who are onboarding as a legal entity, such as a sole proprietor or individual LLC).

- US Persons are individuals with a U.S. Taxpayer Identification Number (TIN) – typically a Social Security Number (SSN).

- Non-US Persons are individuals without a TIN.

- Beneficial Owners are any individuals that own 25% or more of a business.

- Officers are a single individual with responsibility to control manage or direct a business.

There are two types of onboarding applications: Individual and Business. The following are the minimum attributes that are required to be collected and verified for both businesses and individuals.

| Applicant Type | Information Required | Notes |

|---|---|---|

| Individual |

| Copy of Passport and Address Verification is required for all Non-US Persons. Physical Address must be a US address. |

| Business |

| Companies that are publicly traded in a major US stock exchange are subject to lighter onboarding requirements. If your customer base includes publicly traded companies, please reach out to Unit for additional information. Physical Address of the business must be a US address. |

Customer Notification

All Accounts

You must provide your customers with adequate notice that Unit is requesting information to verify their identity. The notice must describe the identification requirements and be provided in a manner that allows a customer to view it before opening their account. The following is a sample notice language:

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT — To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

Customer’s personal information will be protected. Banks and their partners are held to federally regulated standards of protecting customer information. For security reasons, we can't give specifics, but we employ a variety of tools such as encryption, one-time passwords, access controls, and employee background checks to protect customer information.

Business Accounts

In addition to providing a notice that meets the requirements described above, business account notices also must include a beneficial ownership attestation. (Beneficial owners are individuals or businesses that own 25% or more of the business.)

The following beneficial ownership attestation must be shown on the information collection screen:

By providing the information above, I hereby certify, to the best of my knowledge, that the information provided above is complete and correct.

Information Verification

Unit will pass the collected information to our vendors, which will verify the information provided and look for any fraud indicators. At times, a manual review may be necessary.

Manual Reviews

Our goal is to have a completely non-documentary process that enhances the customer experience for both individuals and businesses. However, if a manual review is required, we will perform the review based on when the status of the application turns to “Pending Review”:

| Pending Review Status | SLA |

|---|---|

| Between 8:00am - 8:00pm EST | Manual review completed within two (2) hours of receipt |

| Between 8:00pm - 8:00am EST | Manual reviews completed by 9:00am EST the following day |

Individual Review

The table below outlines the reasons and indicates why an individual applications may be queued for manual review or denied. An application will be automatically approved if none of the flags below is triggered. The end-customer message for approval that will be received is: "Congrats - your application has been approved!"

- Note: This table is for informational purposes only – Unit will provide this information via API, including the message sent to the end customer. Consult the API documentation for further details. Additionally, these flags are shown on Unit's dashboard for each application.

- Note: Please see our technical documents for the requirements to implement Device Fingerprints. There are additional steps to enable device verifications.

| Flag | Description | Providers | Outcome | API message | Message to end customer |

|---|---|---|---|---|---|

| Name Not Verified | KYC failed - last name does not match records | Socure | Manual Review | ID Document Required | Please provide a copy of your unexpired government issued photo ID which would include Drivers License, State ID or Passport. |

| DOB Not Verified | KYC failed - date of birth does not match records | ||||

| DOB Miskey | Individual’s DOB appears to have been miskeyed | ||||

| Minor under 18 | Individual’s DOB lists the applicant as a minor under the age of 18 | ||||

| Fraud Risk | Socure Sigma Fraud Score indicates medium to high risk | ||||

| SSN Not Verified | KYC failed - SSN does not match records | Socure | Manual Review | SSN Verification Required | Please provide a document verifying your Social Security Number (SSN) such as a filed tax return, W-2 or social security card. |

| SSN Miskey | Individual’s SSN appears to have been miskeyed | ||||

| SSN Warning | Multiple SSN tied to identity (e.g. name, address, phone number) | ||||

| Deceased SSN | SSN reported as deceased | ||||

| Address Not Verified | Socure | Manual Review | Address Verification Required | Please provide a document to verify your address. Document may be a utility bill, bank statement, lease agreement or current pay stub. | |

| PO Box | Provided address may be associated with a P.O. Box | ||||

| Address Warning | Address is a correctional facility, inactive, not receiving mail, or vacant | ||||

| Adverse Media | Individual is associated with any type of adverse media, including:

| Socure | Manual Review | Manual Review (required documents will be determined by Unit upon manual review) | We’re having trouble verifying your identity. If your application was processed between 8 am to 8 pm EST, please allow 2 hours for someone to review your application. If your application was received between 8 pm EST to 8 AM EST, we will review your application by 9 AM EST the following day. We will contact you if any additional documentation is needed. |

| OFAC Issue | Individual matches OFAC Consolidated List or OFAC SDN List | ||||

| Domestic PEP Issue | Individual matches any of the domestic Politically Exposed Persons (PEP) lists | ||||

| International PEP Issue | Individual matches any of the International Politically Exposed Persons (PEP) lists | ||||

| Foreign Device Warning | Detects if the application was submitted from an IP address outside of the U.S. Applicable only if Device Fingerprints is enabled, or if the IP is passed in the API request when creating the application | Iovation, Socure | Manual Review | ID Document Required | Please provide a copy of your unexpired government issued photo ID which would include Drivers License, State ID or Passport. |

| Device Warning | Detects if a device has been used for previous application(s) or device risk score is determined to be high risk (ex. Uses a mobile emulator). Applicable only if Device Fingerprints is enabled. | ||||

| Fraud Warning |

| Socure, Sentilink | Deny | N/A | We are unable to verify your identity at this time. Please contact our customer service with questions. |

| Phone Risk | Phone number is flagged as high risk and either Socure's Phone Risk score is high or "Fraud Risk" flagged is triggered | Socure | |||

| Email Risk | Provided email is invalid | Socure | |||

| Device Warning OR Foreign Device combined with Fraud Risk | If either the “Device Warning” or “Foreign Device” flag is triggered as well as the “Fraud Risk” flag. | Socure, Iovation | |||

| Denylist Denied | Information on the application is a match to information on Unit’s internal deny list. The match could be to an SSN, phone number, email, physical address or IP, depending on the reason the individual is on the denylist. | Alloy |

Business Review

Business applications may be flagged for manual review for multiple reasons. The table below outlines these reasons and indicates why such applications may be approved or denied.

An application will be automatically approved if none of the flags below is triggered. The end-customer message for approval that will be received is: "Congrats - your application has been approved!"

In some cases it may take longer to get the business verification from the vendor. In this case, the application status will be "Pending" and the end-customer message will be: "Thank you! Your application is currently under review. It will take a few minutes, so you may stay on this page, but we will get back to you via email in any case."

- Note: This table is for informational purposes only – Unit will provide this information via API, including the message sent to the end customer. Consult the API documentation for further details. Additionally, these flags are shown on Unit's dashboard for each application.

- Note: Each individual associated with the business (Officer or Beneficial Owner) will go through an individual review as specified above. If an Officer or Beneficial Owner is queued for manual review or denied, the business application will go to manual review or will be denied accordingly.

| Flag | Description | Providers | Outcome | API message | Message to end customer |

|---|---|---|---|---|---|

| FEIN Not Verified | Business name could not be associated with the FEIN in Middesk real-time IRS check | Middesk | Manual Review | FEIN Document Required | Please provide a document verifying your Federal EIN such as a filed business tax return, IRS 147c letter or the IRS Form CP 575. |

| Business Address Is A Registered Agent | Business address may be associated with a registered agent. | - | Manual Review | Address Verification Document Required | Please provide a document to verify your operating address. Document may be a utility bill, bank statement, lease agreement or current pay stub. |

| Name Not Verified | Business name could not be found in Middesk real-time state registration database check | Middesk | Manual Review | COI Document Required | For Corporation: Please provide a certified copy of the Articles of Incorporation or Certificate of Incorporation. For Partnership: Please provide a copy of the Partnership Agreement. For LLC: Please provide a certified copy of the Articles of Organization. |

| State Registration Not Matched | The business has no active Secretary of State fillings or no Secretary of State fillings found | ||||

| PO Box | Provided Business Address is a PO Box | Unit | Manual Review | Manual Review (required documents will be determined by Unit upon manual review) | We’re having trouble verifying your business information. If your application was processed between 8 am to 8 pm EST please allow 2 hours for someone to review your application. If your application was received between 8 pm EST to 8 AM EST, we will review your application by 9 AM EST the following day. We will contact you if any additional documentation is needed. |

| OFAC Flag | Business matches OFAC Consolidated List or OFAC SDN List | ||||

| Denylist Denied | Information on the application is a match to information on Unit’s internal deny list. The match could be to an FEIN, phone number, email, physical address or IP, depending on the reason the individual is on the denylist. | Alloy | Deny | N/A | |

| Prohibited Business Type | CDD/EDD verification failed | Unit | Deny | N/A |

Decision Overrides

Applications that are denied or require further documentation for any reason other than a validation reason can be overridden upon client request if the client chooses to accept the risk of opening the account. Examples of situations where an override can be requested without additional documentation include:

- Fraud Risk

- Denied Fraud

- Address Warning

- Device Warning

Approved Document Types:

Additional documentation may be required for identity verification for both individual and consumer applications. Acceptable document types are at the discretion of the bank and may vary between bank partners.

The below table provides examples of document types that may be accepted by your bank partner. This list is not exhaustive and may vary by bank partner. To obtain a current list of your bank approved document types, contact your Unit Customer Success Manager (CSM).

| Business or Individual | Verification Type | Approved Document Types | Notes |

|---|---|---|---|

| Individual | Identity Verification |

| Must include an unexpired government issued photo ID *Work ID and Student ID are only acceptable document types when KYC is being performed on someone under the age of 18 at the time of application *Other foreign photo IDs may be approved as needed and will be added to the list and requested for approval if they become common ID types or a program is onboarded with a specific need. *If an ID is required solely to verify Date of Birth, a birth certificate may also be accepted. * Front and back images of all ID documents except passports are required. |

| Individual/Business | Address Verification |

| Any document used to verify address must be current within the last six months in order to be considered valid *Utility Bills, Bank Statements or Pay Stubs must be current within the last six months. Lease agreement must still be valid (ex. 12 month lease dated 10 months ago) |

| Individual | SSN Verification |

| Tax return or W-2 must be current within the past two filing years The same documents are acceptable for verifying ITIN as well. |

| Business | EIN Verification |

| Tax return must be current within the past two filing years |

| Business | Business Verification |

| Business verification documents vary depending on the business type. This list includes the most common forms of verification; however, there may be others that are considered as well. *If a business is international, proof of organization/incorporation internationally will be required and reviewed with a risk based approach. |

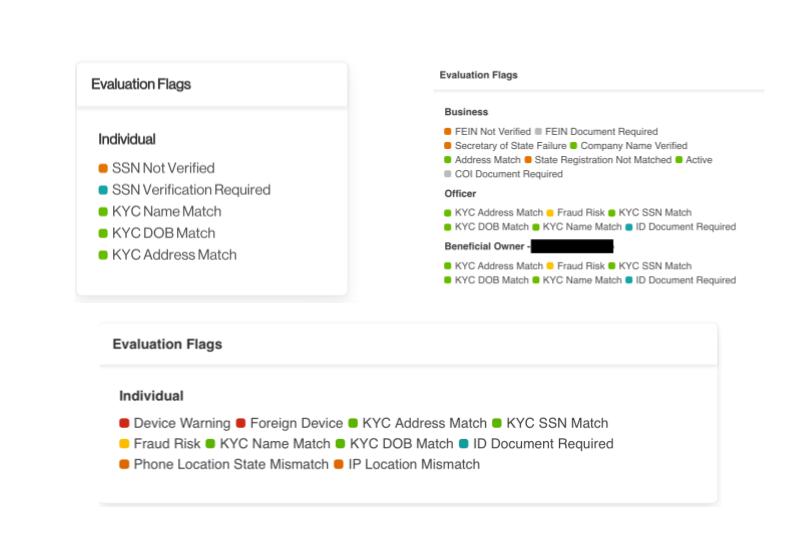

Evaluation Flags

All evaluation flags will be displayed in the Client dashboard in the Application page. The flags are color coordinated:

- Green: good

- Red, orange or yellow: Application was stopped for manual review or document upload

- Blue/Grey: Documents required or informational only (does not impact decisioning)

For businesses, evaluation flags will be displayed for the business, the officer and each beneficial owner.

Document Rejection Reasons

The following table outlines reasons a document may be denied through the automatic document verification tool, Vouched.

- Note: This table is for informational purposes only – Unit will provide this information via API, including the message sent to the end customer. Consult the API documentation for further details.

| Reject Reason | Description | Reason Code | Message to End User |

|---|---|---|---|

| Poor Image Quality |

| PoorQuality | The image provided was unable to be verified due to a poor image quality. Please resubmit the image and be sure all personal information is legible. |

| Name Mismatch |

| NameMismatch | The name on your ID does not match the name on the application. Please resubmit your ID and be sure all personal information is legible. |

| Address Mismatch | Address does not match address on the application | AddressMismatch | The address on the document provided does not match the address on the application. Please resubmit an address verification document with the same address provided on the application. |

| SSN Mismatch | The Social Security Number does not match the SSN on the application | SSNMismatch | The SSN on the Social Security Card provided does not match the SSN on the application. Please confirm the SSN has been entered into the application properly or resubmit a copy of your Social Security Card ensuring the number is legible. |

| Date of Birth Issue | The DOB on the ID does not match the DOB on the application | DOBMismatch | The Date of Birth on the uploaded ID does not match the Date of Birth on the application. Please verify the information on the application is correct or resubmit a document verifying your Date of Birth. |

| Expired ID | The ID provided is expired | ExpiredId | The ID you provided is expired. Please provide a current ID for verification such as Driver’s License, Passport or State ID. |

| EIN Mismatch | The EIN on the document provided does not match the EIN on the application | EINMismatch | The EIN on the document you provided does not match the EIN on the application. Please make sure the information provided on the application is correct and submit documentation verifying the EIN. |

| State of Incorporation Mismatch | The state of incorporation does not match the state of incorporation provided on the application | StateMismatch | The state of incorporation does not match the state of incorporation provided on the application. Please make sure the information provided on the application is correct and submit documentation from the state in which the business is incorporated. |

| Other | Any reason not listed above such as:

| Other | Free text field entered by Unit |