Disputes Overview

Introduction

This guide will cover two types of disputes that your End-Customers may submit: Card disputes, and ACH disputes - for Received ACHs only. We will discuss the roles and responsibilities of each party within the dispute process: The end-customer, you (Unit’s client), Unit and the card processor (for card disputes). Both types are governed by the Federal Reserve’s Regulation E, which establishes the basic rights, liabilities and responsibilities of consumers when using electronic fund transfers.

Card Disputes

In addition to Regulation E, card disputes are also covered by card processors Zero Liability policies. Those policies apply for both individual and business card holders. Zero Liability does not apply to certain commercial cards. The card processors’ Zero Liability Policies are often stricter than Regulation E. For example, Regulation E requires that a consumer will be granted with Provisional Credit within 10 business days (20 business days for new accounts - accounts are considered new if it’s been less than 20 business days from their first deposit) of reporting an unauthorized transaction, whereas Visa’s Zero Liability policy requires that the cardholder will be granted with Provisional Credit within 5 business days.

Card Dispute Types

Unauthorized Transaction Dispute: This is the most common type of card disputes. Cardholders would submit Unauthorized Transaction Disputes when a card is lost or stolen, or in other scenarios in which the sensitive card information is compromised. According to Regulation E and the card processor’s Zero Liability policy, the cardholder is eligible for temporary credit to cover the unauthorized transaction within 5 business days from submitting the dispute. This temporary credit is also known as Provisional Credit. To learn more about card dispute fraud and best practices to handle dispute abuse patterns, please read our Fraud & Disputes guide.

Authorized Transaction Dispute: Cardholders may submit a dispute when a transaction was authorized, but there’s been an issue with the goods that they were eligible for in return: The goods were damaged or not received, or any other type of dissatisfaction with the product or services. Cardholders may not be eligible for Provisional Credit when submitting this type of dispute, with three exceptions:

- ATM terminal dispense error - The cardholder will be granted with Provisional Credit within 10 business days.

- Transactions under $25 - The cardholder will be granted with Provisional Credit within 5 business days.

- Processing Error where the cardholder claims an error in processing or reporting a transaction (Examples: Duplicate Transaction, Paid By Other Means, Incorrect Transaction Amount) - The cardholder will be granted Provisional Credit within 5 business days.

Dispute Lifecycle and Stakeholders

Card disputes are submitted by your customers, by calling the card processor Toll Free Number, which will be provided to you by your Success Manager at Unit. Unit imports a Disputes file from the card processor every business day, so you can expect disputes to be visible in the dashboard one business day after being submitted by the customer. The particular dispute timeline is dependent on the type of the dispute that the cardholder submitted.

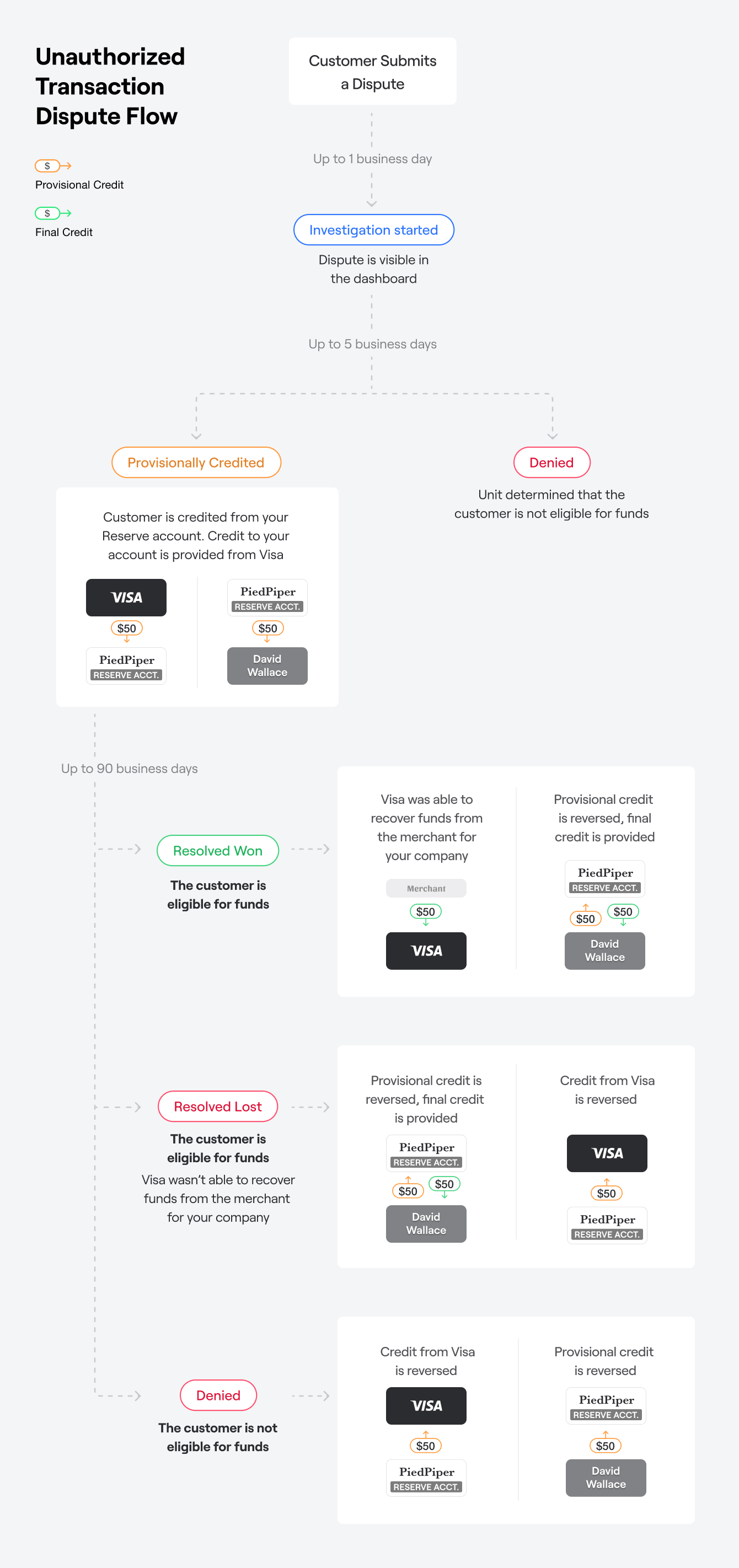

Generally, once a cardholder submits a dispute via the card processor’s Toll Free Number, Unit’s Compliance team will initiate a preliminary review and will post Provisional Credit to the customer’s account within 5-10 business days, if the customer is eligible. Provisional Credit is not provided immediately to allow an initial investigation by the Unit team, and protect against fraud scenarios where the customer immediately withdraws the funds, before the initial investigation concludes that the dispute should be denied. Visa will credit Unit’s client reserve account with dispute settlement credit to temporarily cover the credit that has been given to the cardholder, and start an investigation with the main purpose of looking into the possibility of recovering the funds from the merchant.

Disputes are a Resource in the Unit API. Unit’s clients are able to listen to webhook events and be notified when a dispute is created and updated. Disputes are also visible in the Unit Dashboard within each customer’s page. Based on the general timeline described above, the following section will describe the dispute lifecycle based on possible dispute statuses.

Investigation Started

What it means:

- Once a dispute is submitted by the cardholder via the card processor’s toll free number, the dispute resource will be created in the Unit API with the Investigation Started status, the following business day and up to five business days.

- Unit will start a preliminary review that includes review of past transactions, history and volume of disputes, and materials provided from the client, such as communications with the customer that indicate authorized use of the card, and logs that indicate the customer’s activity and access to their account.

- Unit’s review is followed by a longer investigation by the card processor. The card processor will review the transaction and determine if the merchant should reimburse the funds, based on the card processor rules.

- The card processor investigation includes questions such as: Was the card chip present? Was the PIN entered? Did the merchant have an authorization for the full $ amount, and was the transaction settled properly.

Related Funds Movement: The card processor will provide Unit’s client with dispute settlement credit in 15-25 business days from the start of the investigation, which will be credited to their reserve account during the course of the card processor’s investigation.

Technical aspects: You will be notified about a new dispute using a dispute.created webhook event. Any related money movements will result in transactions with type DisputeTransaction.

Provisionally Credited

- What it means: This status indicates that the cardholder was provided with provisional credit, in one of the following scenarios: Unauthorized transaction dispute, ATM dispense error dispute, and a dispute for <$25 authorized transaction.

- Related funds movement: The cardholder’s account is credited with provisional credit. The credit is debited from Unit’s client reserve account and credited to the end customer’s account.

- Technical aspects: You will be notified about the new status with a dispute.status.change webhook event. Any related money movements will result in transactions with type DisputeTransaction.

Resolved Won

What it means: The dispute was resolved, and the card processor was able to recover funds back from the merchant (“Win” for Unit’s client over merchant).

Related funds movement:

- A reversal to the provisional credit is posted to the cardholder’s account (Debit transaction). They are also credited with the final credit.

- A reversal to the provisional credit is posted to Unit’s client reserve account (Credit transaction) . The final credit is debited from Unit’s client reserve account (Debit transaction).

- No further actions are taken in regards with the temporary dispute settlement credit that was granted from the card processor to Unit’s client when the investigation started, and it is now final.

Technical aspects: You will be notified about the new status with a dispute.status.change webhook event. Any related money movements will result in transactions with type DisputeTransaction.

Resolved Lost

What it means: The dispute was resolved, and the card processor was unable to recover funds back from the merchant (loss for Unit’s client). This status is also used when the dispute is for a transaction that is under the business minimum (<$25), as in these cases funds cannot be recovered from the merchant.

Related funds movement:

- A reversal to the provisional credit is posted to the cardholder’s account (Debit transaction). They are also credited with the final credit.

- A reversal to the provisional credit is posted to Unit’s client reserve account (Credit transaction) . The final credit is debited from Unit’s client reserve account (Debit transaction).

- The card processor will debit Unit’s client's reserve account for the temporary dispute settlement credit that was provided when the investigation started.

Technical aspects: You will be notified about the new status with a dispute.status.change webhook event. Any related money movements will result in transactions with type DisputeTransaction.

Denied

What it means: The dispute was resolved and the cardholder is not eligible for credit. This status could be applied throughout the different stages of the dispute lifecycle:

During Unit’s preliminary review, before provisional credit is granted. Possible reasons for denial are:

- Unit identifies that the merchant refunded the cardholder

- Unit identifies that the dispute was submitted outside of the accepted time frame (up to 60 days from the date of the bank statement in which the disputed transaction appears)

- Unit’s client provides Unit Support with evidence that the transaction was authorized.

During the card processor’s investigation. Possible reasons for denial are:

- The merchant provided the card processor with evidence that shows the transaction was authorized.

- The cardholder did not respond to the card processor request for evidence. This could result in a loss to the client if the cardholder's account is at zero balance or is closed.

- For ATM dispense error disputes, the terminal was in balance according to the vendor and had no errors.

Related funds movement:

- If provisional credit was provided to the cardholder, it will be reversed. If it was already spent, this might cause an overdraft and loss to Unit’s client.

- If settlement credit was provided to Unit’s client, the card processor will debit Unit’s client reserve account.

Technical aspects: You will be notified about the new status with a dispute.status.change webhook event. Any related money movements will result in transactions with type DisputeTransaction.

Card Dispute Process Participants and Responsibilites

| Participant | Cardholder | Unit's Client | Unit | Card Processor | Merchant |

|---|---|---|---|---|---|

| Responsibilities |

|

|

|

|

|

Issuer's Dispute

As Unit’s Client, you are the card issuer and are eligible for an Issuer Dispute if all of the following conditions apply:

- A card transaction was not authorized properly by the merchant (authorization for lower amount or no authorization at all).

- The cardholder has not initiated a dispute for this transaction.

- The cardholder’s account balance is below zero by at least $25 and is not brought to a positive balance within 20 days.

- The difference between the authorized amount and settlement amount is greater than $25.00.

Unit’s client takes the loss for the overdraft, and therefore may submit an issuer dispute to recover the funds. To identify the instances that require an issuer’s dispute, we recommend that you monitor overdrafted accounts and card transactions with no authorization or authorization with lower amounts. You should look back at least 30 days for the authorization, and 90 days for purchases related to travel and entertainment (e.g. hotels, car rentals, flights). Note that the card processor’s rules allow the final settlement to be 20% higher than the original authorization for restaurants and other merchant categories that allow tipping. For travel and entertainment merchants are allowed to submit an estimated authorization request in addition to incremental authorizations plus 15% or $75, whichever is greater.

When identified, escalate to Unit Support (via our Dashboard support or email support@unit.co), and Unit will initiate a dispute with the card processor. The dispute will appear in the dashboard, and will have the same statuses and timeframe that cardholder disputes have. Unit also recommends that the overdrafted account will be closed for Fraud.

ACH Disputes

Overview

End-Customers can submit disputes for Received ACH transactions - ACH transactions that were not initiated by the end-customer, and the end-customer states that they were not authorized or was not processed as agreed upon. Originated ACHs cannot be disputed, as they were initiated by the End-Customer; and ACH transactions in general can not be disputed if your customer is dissatisfied with their purchase or the purchase does not arrive. You can read more on originating vs. receiving an ACH here. In addition to Regulation E, ACH disputes are covered by the NACHA (National Automated Clearing House Association) Operating Rules.

When submitting an ACH dispute, Reg E specifies that the customer has 60 days from the statement to dispute the charge. NACHA rules specify 60 days from the creation of the transaction itself. Unit’s client will be liable for the gap between Reg E timeline and NACHA timeline.

Submitting an ACH Dispute

To submit a dispute, you will need to provide your customer with [this ACH Dispute Form(https://docs.google.com/document/d/1y_uo9hIxq5mmdXxdmCyw3FqCHp4qlgIFdy1vwnVZ4Lk/edit?tab=t.0), and once completed send the form to Unit via our Dashboard Support or via email. You can fill out the form on behalf of your customer, however, it has to include the customer’s signature. The form asks the customer to specify the reason for the dispute: Non authorized, Revoked, Wrong amount, Wrong date, Multiple Charges, Payment Made by Other Means, and Other.

The form includes a section for Check Conversion Entries - this section should be used only when the disputed transaction is an ACH that was converted by the merchant from a check. Once the form is completed and sent to Unit, Unit will review it and resolve within 10 business days. The dispute could result with one of the following outcomes: 1. Unit returns the ACH to the network 2. Unit provides credit to the customer from your reserve account 3. Unit denies the dispute.