Overview

Unit's Check Deposit support gives your end customers the ability to deposit checks and money orders to their Unit account by uploading images of the front and back of the check.

Depositing a Check

Mobile Check Deposit (mRDC)

What is Mobile Check Deposit (mRDC)?

Mobile Check Deposit (mRDC) lets customers make a check deposit by submitting images from a mobile app with no branch visit or paper drop-off. The user photographs the front and back of the check; the app validates the images, captures key data (amount, MICR), and sends the deposit securely for processing.

How it it works?

- The end-customer must first endorse the back of their check or money order with their signature and write ‘For mobile deposit at [Bank_Partner_Name]' below their signature to ensure the deposit is accepted.

- The end-customer captures a front and the back image and inputs the amount to be deposited. Check deposits are subject to limits.

Unit uses the Check Deposits component to allow you to create check deposits, and to capture and upload its images. The main benefit of the component is that it runs client-side validations and provides the customer with immediate feedback on the image quality.

- Once successfully captured, the check or money order image will be parsed for amount, sender account number, and other details. The image will be analyzed for fraud signals, such as missing signatures or security features. Your check will return with one of the statuses in the following table.

Contact your Success Manager to confirm the check deposit cut-off time for your org.

| Status | |

|---|---|

Pending | The check will be in status pending until it is sent to the network. If a deposit is made after the cut-off time, the check will be processed the following business day. |

PendingReview | Checks may be sent to manual review, depending on the specifics of the use case and risk of fraud. Upon completion, status will change to either Pending or Rejected |

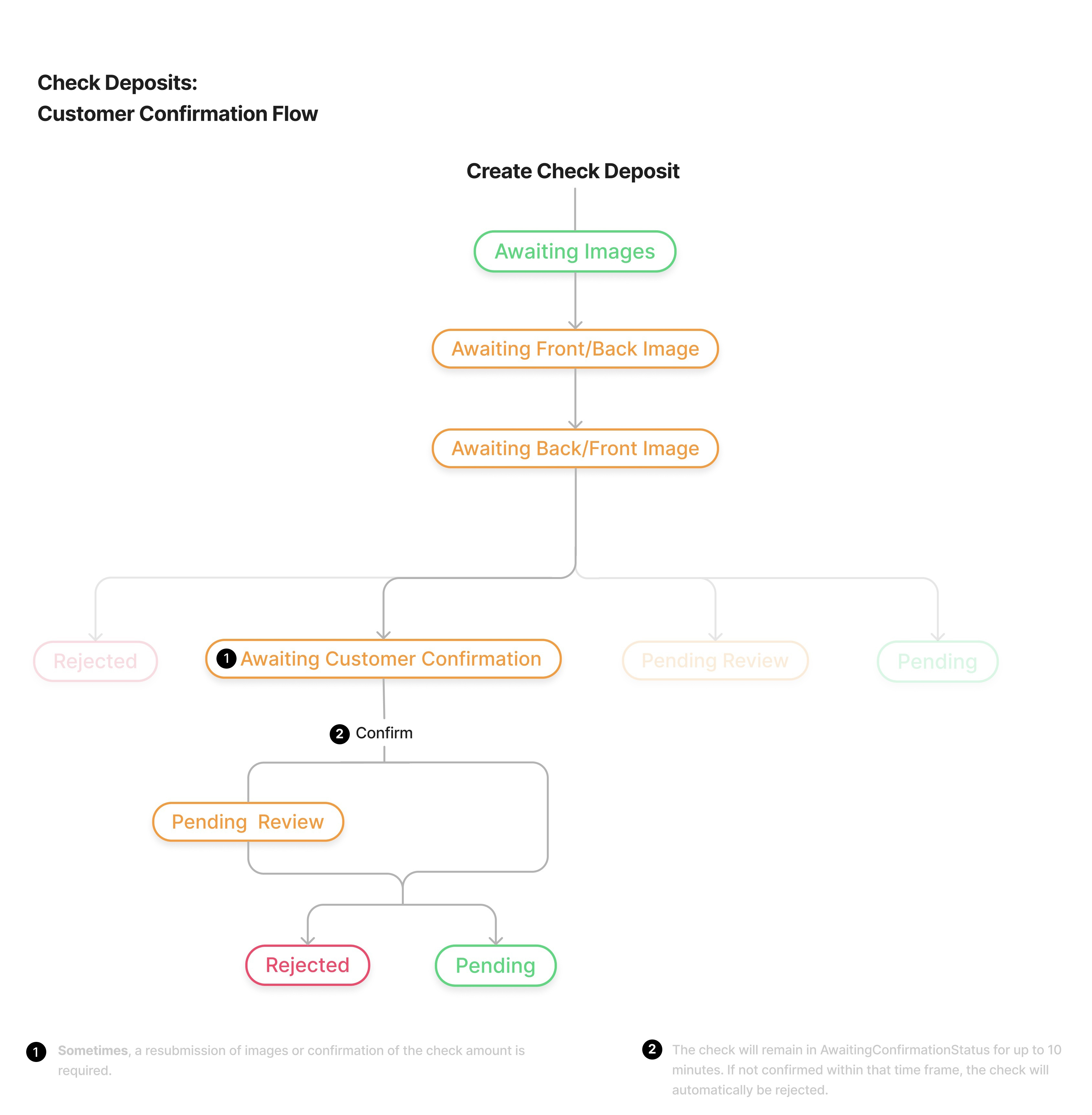

awaitingCustomerConfirmation | The attention of the customer is required. The customer should be prompt to retake images or confirm or amend one of the input fields. See Awaiting Customer Confirmation Reasons. Once update is submitted, confirm the check deposit. Check will go into one of the other 3 statuses |

Rejected | See Rejected Checks below for possible rejection reasons. |

- Once the check is sent to the network and is successfully processed, the funds will be received by Unit. At that point, the check deposit will change its status to clearing.

- When the clearing period is over, the funds will be released to the end customer. We recommend that customers keep the physical check until the end of the statement cycle.

Lockbox Check Deposit (Lockbox RDC)

What is a Lockbox?

A lockbox is a special mailing address run by a bank or specialist. Your customers mail their checks there. The lockbox team opens the envelopes, scans the checks, captures the key details, and sends the deposits electronically so money reaches your accounts faster and you don’t have to run a mailroom.

Why using a lockbox?

- Faster cash flow - Less time lost in the mail and in your office.

- Fewer manual tasks - No opening envelopes or scanning checks yourself.

- Scales easily - Spikes in volume don’t become your problem.

- Clean records - Consistent images and data for reconciliation.

Typical use cases

- Retail/consumer payments: Lots of smaller, similar payments (utilities, insurance, donations).

- Wholesale/B2B remittances: Fewer checks, larger amounts, more varied remittance details.

- Distributed teams: Branches/offices scan locally but feed the same central process.

What you’ll need before you start?

- A lockbox address - Given by your lockbox provider (or bank). This is the mailing address you share with customers.

- A daily file from the provider - The provider will send you a batch of that day’s checks. It can be:

- A folder of images plus an index file, or

- One multi-page PDF/TIFF plus a CSV/ICL index, or

- Another standardized package they support.

Don’t worry about the format, the key is that each check has: Front and back images + basic fields (usually the amount; sometimes payer/vendor identifiers)

- Light ingestion step on your side: A small service (by you or your vendor) that:

- Pulls the daily batch

- Splits it into individual checks

- Saves front/back images as JPEG (the format Unit expects)

- Reads the amount (if provided) or lets your team confirm it

- Adds simple batch info (see “Helpful metadata” below)

Step-by-step: From mail to deposit

- Checks are mailed to the lockbox: You share the lockbox address with your customers, this is where they’ll send their checks.

- Provider preps and scans: They open the mail, group items into a batch (e.g.,

LBX-PHX_2025-08-28_AM), and scan each check front/back. - You receive the daily batch file: This might be delivered via SFTP, portal, or API depending on your provider.

- Split the batch into individual checks (your ingestion step): For each check:

- Extract front and back images and convert them to

JPEG. - Capture the amount from the index (or have your team confirm).

- Keep simple batch details for traceability.

- Extract front and back images and convert them to

- Create the deposits in Unit: For each check, your system makes one deposit in Unit and uploads its two images

- Create Check Deposit - Create a deposit for the destination account (include

amountand optional metadata as adescription/tagssuch asbatch,scannerId,location,operator. see “Helpful metadata” below) - Upload Front Image - Use

JPEGformat. - Upload Back Image - Use

JPEGformat.

- Create Check Deposit - Create a deposit for the destination account (include

- After creation, the check follows the same path as mobile RDC (review, clearing, returns). No special handling needed.

Helpful metadata (makes ops & audits easier)

For each deposit in Unit, add a brief description or tags to capture key details. Example:

- Batch:

batch=LBX-PHX_2025-08-28_AM - Scanner:

scannerId=PHX-01 - Location:

location=Phoenix Mailroom - Operator:

operator=Maria

Customer Confirmation

Customer confirmation is disabled by default. Contact your Success Manager for more details.

When opted in for this feature and once check images are successfully captured, the check or money order image will be parsed for amount, sender account number, and other details. In cases where the image analysis reveals an discrepancy between the customer's input and the information extracted from the images, the check will not be rejected, instead, the customer may be prompt to confirm or amend the mismatched information (e.g. check amount ) or retake image (e.g. check is not endorsed). See Awaiting Customer Confirmation Reasons. The time frame allowed for confirmation is 10 minutes, after which if the check hasn't been confirmed yet, it will be rejected.

Once new image(s) are uploaded or check is updated, Use confirm to resubmit the check. Check will go into one either Pending, PendingReview or Rejected status instantly.

Ineligible Checks

Checks may not be accepted if they are:

- in a currency other than US Dollars

- payable to someone other than the end customer

- savings bonds or traveler's checks

- have already been deposited

- not readable

- checks without a date, have been post-dated, or are more than 6 months old

Commercial Terms & Prerequisites

Mobile Check Deposit is supported for mobile applications only.

If not already included, Mobile Check Deposit will be added to your Unit Terms Sheet for your implementation. There will be a standard cost for each check uploaded to Unit.

Contact your Success Manager for more details.

Compliance

- Client Services Agreement: Mobile Check Deposit should already be included in your existing Client Services Agreement. Contact Unit Compliance if you have any concerns.

- Deposit Agreement: Check deposits have their own terms which will need to be disclosed in your end customer's Deposit Agreement.

Contact Unit Compliance for required changes or additions to your program's agreements.

Tech Integration

Unit uses the Check Deposits component to allow you to create check deposits, and to capture and upload its images. The main benefit of the component is that it runs client-side validations and provides the customer with immediate feedback on the image quality.

| API Call | Event | Comment | |

|---|---|---|---|

| T | Create Check Deposit | This endpoint has been deprecated and replaced with the Check Deposit White-Label UIs Check Deposits component. | |

| T | Upload front image | This endpoint has been deprecated and replaced with the Check Deposit White-Label UIs Check Deposits component. | |

| T | Upload back image | checkDeposit.created | The event is fired after the second of the 2 images is successfully uploaded (upload order does not matter). This endpoint has been deprecated and replaced with the Check Deposit White-Label UIs Check Deposits component. |

| T + 1 | checkDeposit.clearing | ||

| T + clearing | checkDeposit.sent | ||

| T + clearing | transaction.created | Transaction type: checkDepositTransaction |

Rejected Checks

Attempts to deposit checks may be rejected by Unit either in real time or asynchronously. You will learn of a check being rejected by listening to the checkDeposit.rejected event.

Real-time rejection happens during image capture, or upon further processing after the image has been uploaded. Issues with image capture are typically resolvable by the end customer, while issues with further processing can result in a rejection (requiring your end customer to retry the check deposit), or be routed to a Manual Review.

We’ve outlined the most common of each type below. Note this list does not include check returns, which are initiated by the issuing bank after the check has been sent to the check network for processing.

Rejected in real time

| Error | Action |

|---|---|

| Corners are not fully visible (eg. out of frame, folded or torn off) | Hold camera directly over check and make sure that all four corners are visible within the camera frame. |

| Front or back image out of focus or un-processable | Hold camera directly over check and ensure image resolution is sharp. |

| Check elements are unreadable (too dark, too light, check is folded) | Flatten the check and place on a dark surface in a well-lit area. |

| Back (Front) Image Looks like Front (Back) | Re-upload back (front) image |

| Back Signature Not Detected | Endorse back of check and recapture image. |

Rejected asynchronously (or manual review Required)

| Error | Action |

|---|---|

| Daily limit exceeded | Reject, user to retry later |

| Transaction limit exceeded | Reject |

| Front signature not detected | Reject |

| Amount not recognized by OCR | Manual review |

| Amount appears changed by depositor | Manual review |

| Potential Duplicate Check | Reject |

Returns

Checks may be returned by the issuing bank for a period of time after the check has been deposited. The most common reasons are insufficient funds, account doesn't exist, and unauthorized. The exact timeframe for returns varies by the specific return reason. Most are returned within 24 hours, though some returns can happen up to 60 days after the check has been deposited. Additionally, returns for Duplicate Presentment can be made for up to one year, and Forged Endorsement or Altered Items can take up to three years. Regulation dictates that funds must be returned immediately if the issuing bank issues a return.

Clearing

Clearing is a mechanism that allows you to reduce the risk of loss due to check returns. If a return has been issued after the funds have been spent, a check return will push the account into a negative balance.

The clearing period is a number of days (typically five days) in which the funds are stored in a special purpose clearing account before they are released to the end-customer. As most returns happen in the first few days, longer clearing periods reduce the risk of a return happening after the funds have been spent, though this is a trade off against the ideal customer experience.

Manual Review

Mobile Check Deposits may be routed to manual review to minimize fraud while ensuring the best possible success rates. Manual Reviews will be completed same day if the check is submitted in advance of the cut off time.

Unit will inform you when the review is complete and what was the outcome via events.

Dashboard

Check deposits are presented on the Unit Dashboard on the Check Deposits tab.