Network & Processor Fees

Background & Definitions

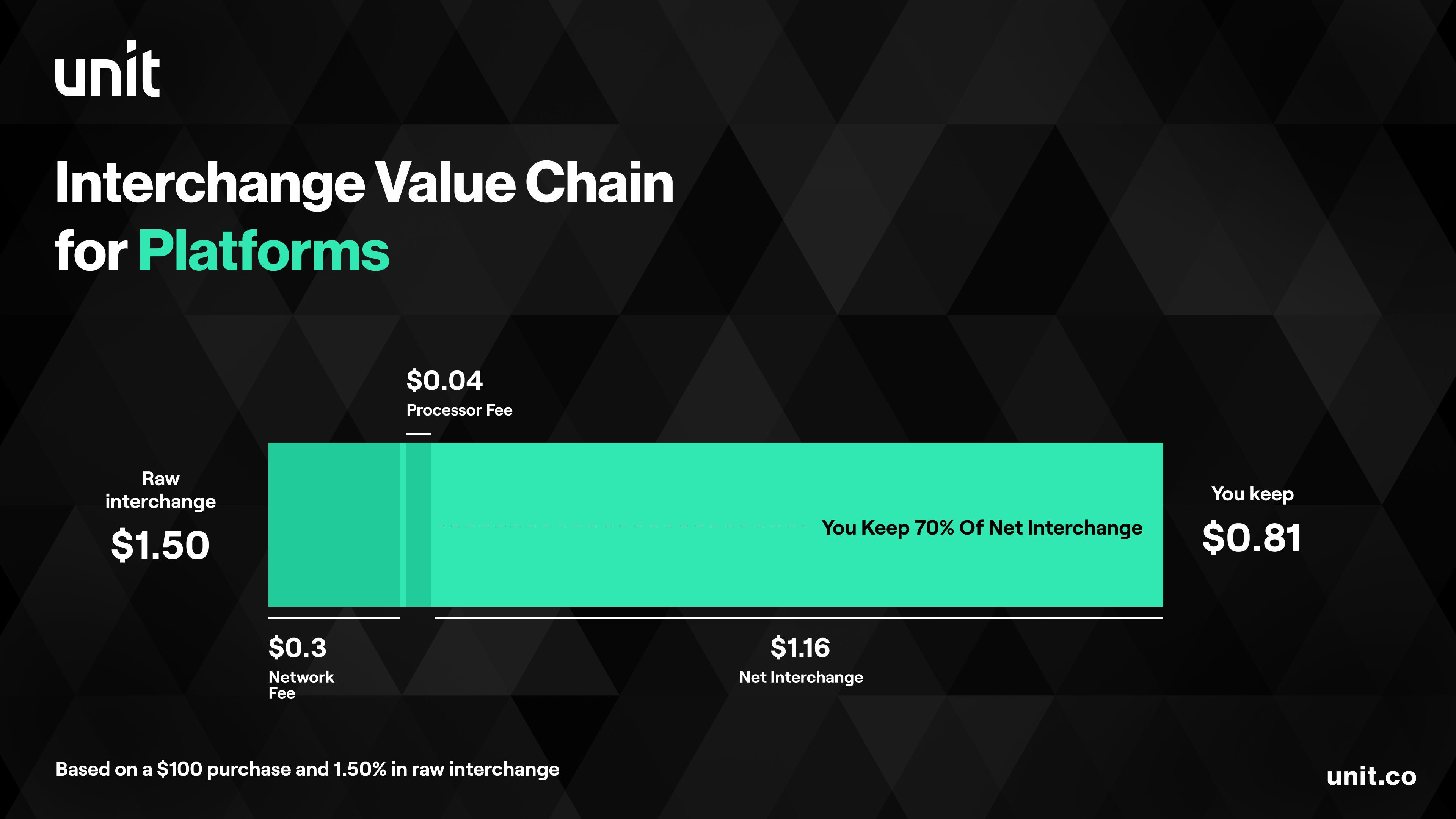

Gross Interchange (sometimes referred to as Raw Interchange or Total Interchange) is the fee merchants pay to card issuers each time a card transaction is processed (see Unit’s interchange guide).

Processor Fees are paid by card issuers to their issuer processors who provide connectivity to merchants via payment networks, and are responsible for tracking and maintaining the records of payment activity.

Network Fees are paid by card issuers to the payment networks that route transactions between merchants and processors.

Net Interchange is the summary calculation that equals (Gross Interchange) - (Network Fees + Processor Fees).

Your Interchange Share is the percentage of interchange you receive as stated in your contract.

Your Interchange Revenue is the calculation that equals (Client Interchange Share) x (Gross Interchange - Network Fees + Processor Fees) .

Unit’s Cards Ecosystem

| Function | Provider |

|---|---|

| Card Issuer | Unit in partnership with our bank partners and clients |

| Issuer Processor | Visa DPS |

| Networks | - VisaNet – Visa’s primary signature network - Interlink – Visa’s primary PIN network - Accel –Regulatorily mandated secondary network - Plus – Visa’s ATM network - Allpoint* –Optional surcharge-free ATM network |

*Allpoint fees are unique in that they are billed as part of Unit’s monthly invoicing process.

Net Interchange Model

Unit’s model – just like that of other banking-as-a-service providers – is designed to pay you your share of interchange while passing through network and processor fees.

In the above example, the raw or gross interchange is 1.5% of the purchase amount, but in reality the numbers vary. Interchange is always a small fraction of the amount spent, but this fraction varies from transaction to transaction. The same is true of network and processor fees. The fees shown above will vary as will the impact of the fees relative to the interchange generated. Also, the 70% net interchange share is shown for illustrative purposes and may not represent a customer’s actual interchange share.

Understanding Fees

Like interchange, network and processor fees are extremely complex and vary significantly from transaction to transaction. Here are some of the variables that impact fees:

- Some fees are a flat rate per transaction, while others are a percentage of the transaction amount

- Business transactions = lower network fees, lower fee impact

- Larger transactions = lower fee impact due to relatively lower impact of flat rate per transaction network fees

- Some transaction types have a higher fee impact, including:

- ATM withdrawals

- OCT (Original Credit Transaction - funds pushed to a cardholder’s account through their debit card)

- AFT (Account Funding Transaction - funds pulled from a cardholder’s account through their debit card, typically with the intention of funding another account)

- Lower authorization rate (more declined transactions) = higher fee impact because declined transactions produce fees without generating interchange

Interchange Payment & Fee Mechanics

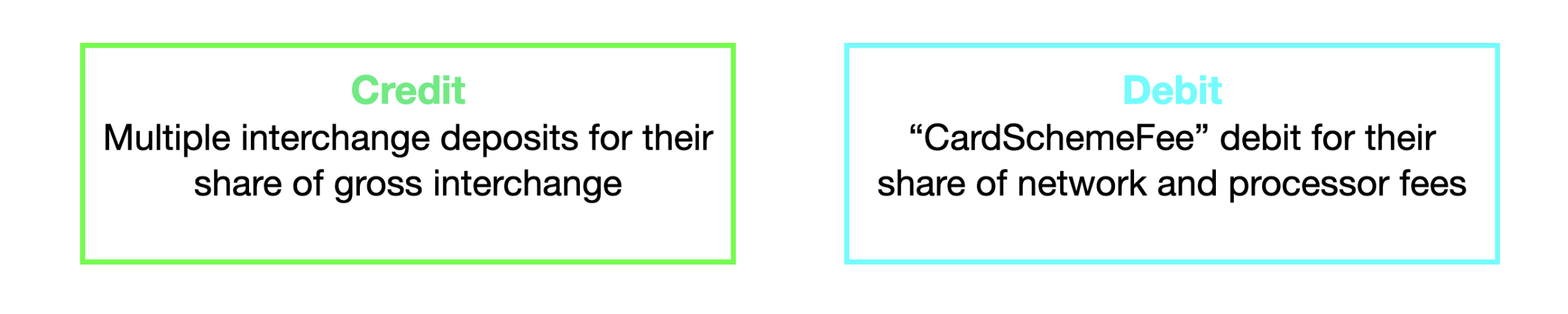

On a daily basis, you are paid your share of the gross interchange generated for your card activity and are also debited for your share of network and processor fees.

You will see the following daily activity on your revenue account:

While Unit is crediting interchange and debiting fees on a daily basis, it’s not guaranteed that the fees charged on a given day correlate to the same transactions as the interchange revenue paid out for that day. The reason for this is that interchange revenue often lags 1-2 days from the time the transaction is completed, while the network and processor fees are often charged on the same (or next) day.

Interchange Payment & Fee Example

The example below is provided for illustrative purposes only and may not represent an actual revenue share and fees.

In this example, your interchange share is 70%. Over the course of a month, the total gross interchange generated by your card activity is $90k (for simplicity, assume it’s $3k per day), and the total network and processor fees accrued are $30k (for simplicity, assume it’s $1k per day).

For that month, your interchange revenue is 70% x ($90k-$30k) = $42k and each day they will see the following activity on your revenue account:

- Multiple deposits for your share of gross interchange totaling $2.1k (70% of the $3k in total daily interchange generated)

- “CardSchemeFee” debit for your share of network and processor fees equal to $700 (70% of the $1k in daily fees generated)